Pensions are great, but they are complicated. A recent ruling has made pensions particularly complicated for certain individuals. Some people who have a public service pension scheme (particularly individuals who work for the NHS or senior local government) may be affected by the ‘McCloud Judgement’.

We won’t go into the ins and outs of the calculations or how they have been generated… This blog will focus on the tax reporting requirements.

Dr Smith has been doing a tax return each year. There isn’t too much to report, but her income is above £100,000 and there’s a bit of bank interest/gift aid. Dr Smith also has her pension statement – which is sent to her each year by her employer/pension scheme administrator (let’s say the SPPA – Scottish Public Pensions Authority). The statement is usually quite clear with what has been added to the pension – the “Pension Input Amount”. Dr Smith’s tax adviser states that “too much” has gone into her pension and there is a tax charge reported in the tax return – This can be paid from the pension directly – via scheme pays – or simply paid as part of the January income tax liability.

This is normal, there may be some unused allowances from the last 3 years to reduce the pension charge, or maybe the income was large enough to “taper” the allowance, but overall, it’s not exceptionally complicated.

Well, following a legal determination (all to do with age discrimination) those figures on the pension statement which Dr Smith has diligently provided to her tax adviser each year could now be wrong, and they are going to be recalculated.

They could be recalculated as far back as April 2015.

Let’s say Dr Smith exceeded her pension annual allowance by £5,000 every year since 2015/16. This has been reported on her tax return each year based on the statements provided by the pension administrator. Those statements could now be wrong, Dr Smith then receives a new statement with different historic figures stating that she didn’t exceed the allowance in any year. Dr Smith has overpaid tax, and overpaid tax by quite a lot:

|

Financial year |

Exceeded pension allowance |

Tax overpaid* |

|

2015/16 |

£5,000 |

40% at £5,000 = £2,000 |

|

2016/17 |

£5,000 |

40% at £5,000 = £2,000 |

|

2017/18 |

£5,000 |

41% at £5,000 = £2,050 |

|

2018/19 |

£5,000 |

46% at £5,000 = £2,250 |

|

2019/20 |

£5,000 |

46% at £5,000 = £2,300 |

|

2020/21 |

£5,000 |

46% at £5,000 = £2,300 |

|

2021/22 |

£5,000 |

46% at £5,000 = £2,300 |

|

2022/23 |

Not been reported as the statement will not have arrived in time for the 31 January 2024 submission deadline. |

|

|

Total tax paid on excess pension contributions |

£15,200 |

|

*The increasing change in (Scottish) tax rates reflect her salary increase, which pushes her into the highest bands over that period

Total tax paid on excess pension contributions = £15,200

Dr Smith would now be due a repayment for all that tax (good news!) There also might be some unused allowances, maybe setting up another pension to add funds would be a good option too.

Now let’s say that the new statement arrives and some years have exceeded the allowance and some years have been under the allowance. We are currently expecting these letters by October 2024.

This isn’t as simple as applying the rates to the new numbers. It will require a complete rework of the unused allowances carried forward, potentially even a recalculation of any tapered allowances.

In some cases, there will be a refund due and in some cases, there will be tax due. At this point, it is too difficult to know.

A refund will either be paid directly to the pension scheme (to increase the value of the pension) or to the taxpayer directly. As with most things in tax – “it depends” on the situation.

“Scheme pays” may be available for anyone who has an increase in their liability – but it will need to be claimed specifically.

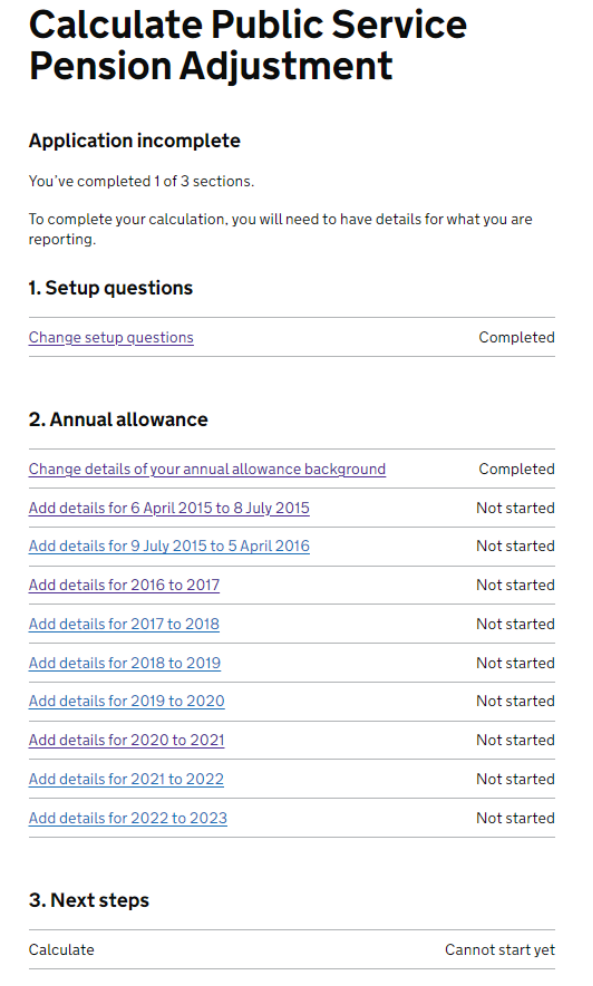

These changes would be far too complex to report on historic tax returns and it would be too “clunky” to send amendments. HMRC have produced a new pension calculation service to deal with this problem specifically. But we will likely need the historic tax returns going back to 2015/16 – assuming they have been submitted!

We have now seen this new service and it looks very similar to the Trust Registration Service or the 60-Day CGT Return Service which HMRC have had in operation for a few years now. See picture:

We would highly recommend seeking professional tax advice to report the recalculations. If you or any of your clients would like help dealing with the McCloud Remedy or pension allowance charges in general, please do not hesitate to contact our Tax Director – James Edwards, who knows more than a thing or two about this topic. Email us at Enable JavaScript to view protected content. or give us a call on 0131 364 4191.

© 2024 Anderson & Edwards Ltd|Registered in Scotland SC678768|Privacy Policy|Website by Broxden